Asset protection is a crucial aspect of financial planning that is often overlooked. Many individuals and businesses focus on accumulating assets without considering the potential risks that could threaten their hard-earned wealth. Asset protection involves implementing strategies and measures to safeguard one’s assets from potential threats such as lawsuits, creditors, and unforeseen financial liabilities. By proactively protecting your assets, you can mitigate the risk of losing everything you’ve worked for in the event of a legal dispute or financial crisis.

One of the key reasons why asset protection is important is to safeguard your wealth for future generations. Without proper protection, your assets could be vulnerable to legal claims or creditors, leaving your loved ones with little to inherit. Additionally, asset protection can provide peace of mind and financial security, knowing that your hard-earned assets are shielded from potential risks. Whether you’re an individual with personal assets or a business owner with commercial assets, implementing asset protection strategies is essential for long-term financial stability and wealth preservation.

Key Takeaways

- Asset protection is crucial for safeguarding your wealth and investments from potential risks and liabilities.

- Comprehensive insurance coverage provides financial protection against a wide range of risks, including property damage, liability, and personal injury.

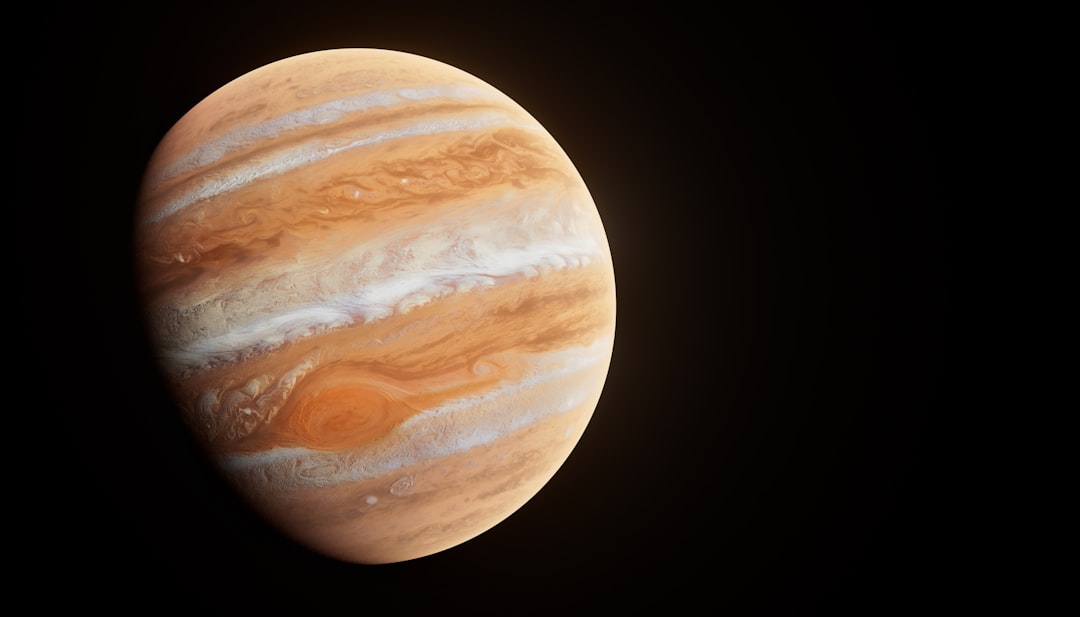

- Jupiter Insurance offers a variety of coverage options, including property insurance, liability insurance, and umbrella insurance.

- When choosing coverage for your assets, consider factors such as the value of your assets, potential risks, and your budget.

- Understanding the claims process with Jupiter Insurance can help you navigate the process smoothly and efficiently in the event of a loss or damage.

The Benefits of Comprehensive Insurance Coverage

Comprehensive insurance coverage plays a vital role in asset protection by providing financial security and peace of mind in the face of unexpected events. Whether it’s your home, car, business, or personal belongings, comprehensive insurance coverage can help mitigate the financial impact of unforeseen circumstances such as natural disasters, accidents, theft, or liability claims. By having the right insurance coverage in place, you can protect your assets and minimize the financial burden of repairing or replacing them in the event of a covered loss.

One of the key benefits of comprehensive insurance coverage is the financial protection it provides against a wide range of risks. From property damage to personal injury claims, comprehensive insurance policies are designed to offer extensive coverage to safeguard your assets and mitigate potential financial losses. Additionally, comprehensive insurance coverage can provide legal protection by covering the costs of legal defense and settlements in the event of liability claims or lawsuits. By having the right insurance coverage in place, you can protect your assets and ensure financial stability for yourself and your loved ones.

Exploring the Coverage Options Offered by Jupiter Insurance

Jupiter Insurance offers a wide range of coverage options to meet the diverse needs of individuals and businesses seeking comprehensive asset protection. Whether you’re looking for home insurance, auto insurance, commercial property insurance, or liability coverage, Jupiter Insurance provides customizable policies tailored to your specific needs. With a focus on delivering quality coverage and exceptional customer service, Jupiter Insurance is committed to helping clients safeguard their assets and achieve peace of mind.

Home insurance from Jupiter Insurance offers protection for your most valuable asset, covering damages to your home and personal belongings caused by covered perils such as fire, theft, vandalism, and natural disasters. In addition to property coverage, Jupiter Insurance also provides liability protection to safeguard homeowners against legal claims and medical expenses in the event of accidents or injuries on their property. For auto insurance, Jupiter Insurance offers comprehensive coverage options including collision, comprehensive, liability, and uninsured/underinsured motorist coverage to protect you and your vehicle from various risks on the road.

Tips for Choosing the Right Coverage for Your Assets

When it comes to choosing the right coverage for your assets, it’s important to assess your specific needs and risks to determine the most suitable insurance policies. Start by evaluating your assets, including your home, vehicles, personal belongings, and business properties, to identify the potential risks they are exposed to. Consider factors such as location, weather patterns, property value, and usage to determine the level of coverage needed to adequately protect your assets.

Another important tip for choosing the right coverage is to work with a reputable insurance provider like Jupiter Insurance that offers customizable policies and personalized guidance. By consulting with experienced insurance professionals, you can gain valuable insights into the best coverage options for your assets and receive expert recommendations tailored to your unique needs. Additionally, it’s essential to review and compare different insurance policies to understand their coverage limits, deductibles, exclusions, and additional benefits before making a decision.

Understanding the Claims Process with Jupiter Insurance

In the event of a covered loss or damage to your assets, understanding the claims process with Jupiter Insurance is essential for a smooth and efficient resolution. When filing a claim, it’s important to promptly report the incident to Jupiter Insurance and provide all necessary documentation and evidence to support your claim. This may include photographs, police reports, repair estimates, and any other relevant information requested by the insurance company.

Once your claim is submitted, Jupiter Insurance will assign a claims adjuster to assess the damages and determine the coverage applicable to your policy. It’s important to cooperate with the claims adjuster and provide accurate information to facilitate the claims process. Jupiter Insurance is committed to providing timely and fair claim settlements to help clients recover from unexpected losses and restore their assets to their pre-loss condition.

Additional Services and Resources Offered by Jupiter Insurance

In addition to comprehensive insurance coverage, Jupiter Insurance offers a range of additional services and resources to support clients in protecting their assets and managing risks effectively. These services may include risk assessment consultations, loss prevention guidance, and access to educational materials and resources on asset protection and insurance best practices. By leveraging these additional services, clients can gain valuable insights into minimizing risks and maximizing their asset protection strategies.

Jupiter Insurance also provides personalized customer support to address any questions or concerns related to insurance coverage, claims processing, policy management, and risk mitigation. With a dedicated team of insurance professionals, Jupiter Insurance is committed to delivering exceptional service and support to ensure that clients have the resources they need to protect their assets and achieve peace of mind.

Ensuring Peace of Mind with Jupiter Insurance

Ultimately, partnering with Jupiter Insurance is an effective way to ensure peace of mind and financial security by protecting your assets from potential risks. With comprehensive insurance coverage options, personalized guidance, efficient claims processing, and additional resources, Jupiter Insurance is dedicated to helping clients safeguard their wealth and achieve long-term financial stability. By choosing Jupiter Insurance as your trusted insurance provider, you can have confidence in knowing that your assets are well-protected and that you have a reliable partner to support you through any unexpected events or challenges.

Looking for more information on insurance options? Check out this insightful article on Usthyme that discusses the importance of understanding different types of insurance coverage and how to choose the right policy for your needs. Whether you’re considering home, auto, or life insurance, it’s crucial to be well-informed before making any decisions. Click here to read the full article and gain valuable insights into the world of insurance.

FAQs

What is Jupiter Insurance?

Jupiter Insurance is a company that provides various insurance products and services to individuals and businesses. They offer a range of coverage options including auto, home, life, and business insurance.

What types of insurance does Jupiter Insurance offer?

Jupiter Insurance offers a wide range of insurance products including auto insurance, home insurance, life insurance, business insurance, and other specialty insurance products.

How can I get a quote for insurance from Jupiter Insurance?

You can get a quote for insurance from Jupiter Insurance by visiting their website and filling out an online quote request form. You can also contact their customer service team to get a personalized quote.

Is Jupiter Insurance a reputable company?

Jupiter Insurance has a strong reputation in the insurance industry and is known for providing reliable coverage and excellent customer service. They have a history of financial stability and a track record of paying claims promptly.

Does Jupiter Insurance offer discounts on insurance premiums?

Jupiter Insurance offers various discounts on insurance premiums for eligible policyholders. These discounts may be available for factors such as safe driving, bundling multiple policies, and installing safety devices in your home or vehicle.

Can I file a claim with Jupiter Insurance online?

Yes, Jupiter Insurance provides the option to file a claim online through their website. You can also contact their claims department directly by phone to report a claim and get the process started.